Compliment of the Month: TenneT explores potential for Long Duration Energy Storage

In our Compliment of the Month series, each month we highlight a party that is working to accelerate the energy transition. For April, our appreciation goes to TenneT, which in its Monitor of Security of Supply 2025 calculated the effects of Long Duration Energy Storage (LDES) for the first time, making an important contribution to understanding and securing our future energy supply.

Contribution Intraday and multiday LDES to security of supply.

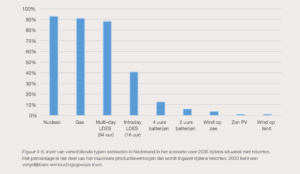

LDES differs from conventional lithium-ion batteries in that it can hold energy for days rather than just a few hours. TenneT therefore added two types of LDES to the model: intraday-LDES and Multiday-LDES. Intraday-LDES is modeled with 16 hours of supply per megawatt of power, which amounts to 16 MWh per MW that can be deployed at any time. Multiday-LDES, in the form of Compressed Air Energy Storage (CAES), utilizes underground salt caverns and can store as much as 84 hours of energy without significant losses.

The calculation shows that intraday-LDES in shortage periods provides about 40% of its capacity and multiday-LDES even nearly 90%. In comparison, short-cycle 2- or 4-hour batteries deploy only about 12% of their capacity in shortages. Thus, longer storage cycles allow LDES to release much more "firm power" at times when conventional flexibility options reach their limits. This additional deployability translates directly into lower LOLE (Loss of Load Expectation) and reduced EENS (Expected Energy Not Served), as calculated in the Monitor.

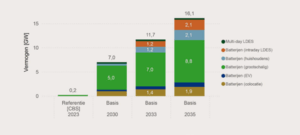

Projected growth toward 2035

Because LDES systems can buffer and feed back excess wind and solar energy when production is low, they will play an increasingly important role. TenneT expects installed LDES capacity to grow steadily until 2033 and then even further towards 2035. This growth, according to Tennet, not only supports security of supply, but also helps reduce dependence on fossil reserves and smooth out price fluctuations in the electricity market.

At the same time, TenneT emphasizes the challenges facing LDES. Initial capital costs are high and payback periods can be ten years or longer, deterring private investors. In addition, electricity price volatility leads to unpredictable revenues, making the business case seem unreliable. Public concerns about underground storage and the use of certain chemicals also come into play.

Recommendation and Outlook

To overcome these obstacles, TenneT points to inspiring examples from abroad. The United Kingdom uses a Cap-and-Floor scheme that provides investors with guaranteed minimum and maximum income, thus reducing risk. Spain compensates with Capacity Payments for available capital regardless of actual deployment, which promotes investment and grid stability. In Germany, projects receive subsidies, low-cost loans and tax breaks, then compete in the free market and benefit from price volatility.

Based on these international examples, TenneT recommends that the Dutch government also explore incentives for medium- and long-term energy storage, in addition to known instruments such as gas-fired power plants, demand response and interconnection.